Data Science is an inseparable component from any industry & finance sector is no exception. Financial institutions use Data Science for various reasons such as customer portfolio management, analyzing trends in data through business intelligence tools, fraud detection in transactions & insurance claims, etc.

Data Science is also being utilized in algorithmic trading where machine learning plays a pivotal role in making predictions about the future market.

Let's read about the 5 amazing uses of data science in finance & understand how Data Science is used in finance sector:

Customer Data Management

Industries utilize machine learning to generate insights about the customers and extract business intelligence There are various tools in Artificial Intelligence like Natural Language Processing, data mining and text analytics that generate meaningful insights from the data.

Integrating Big Data in the financial institution systems helps the banks & other Fintech operatives to gather & nurture customer data more efficiently.

The number of transactions & social media also, in a way help the institutions in gathering customer data in large volumes & variety.

The data gathered is further utilized to understand customer psyche & their buying behavior, which further helps the banks to offer personalized services to their customers & add value to their overall banking experience.

Real-Time Analytics

With so many technologies such as Artificial Intelligence, Machine Learning, Big Data running in the background, it becomes very easy for the financial institutions to predict the market trends in real-time & produce reliable results with minimal latency.

Previously, the traditional analytics processed data in the form of batches, so the data was majorly based only on historical events & did not provide real-time results.

But with the introduction & application of Data Science in Finance, institutions are now able to track transactions, credit scores and other financial attributes without any complications & delays.

Providing Personalized Services

Financial Institutions use a variety of techniques to study customer information and generate insights about their interactions, product purchase history among many other things.

Not only this, but financial institutions are also relying on speech recognition and natural language processing based softwares to provide better insights into what the customer really needs. Application of Data Science has made the process customer-centric to a large extent.

The data provided by the users, helps the financial institutions to take actionable insights of their customer needs which leads to an increase in profit & further helps the institutes to optimize their strategies and provide better services to their customers.

Algorithmic Trading

Big Data has massively impacted algorithmic trading and with the application of its most important feature, Data Science. Algorithmic Trading is the crucial part of financial institutions. The complex mathematical formulas and quick computations, which are part of Algorithmic trading, help the financial companies to devise new trading strategies.

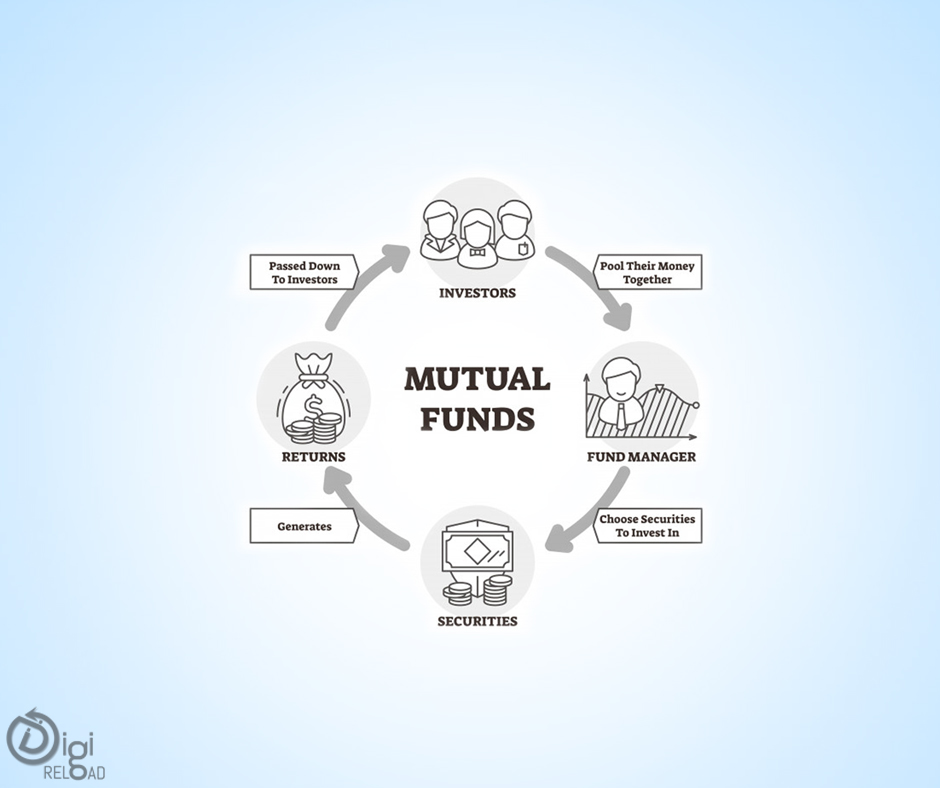

But, every permutation & combination of the algorithm is only possible because of the application of Data Science & Machine Learning technologies of modern day banking trends. All the stock market trading, equity markets, mutual funds, & all banking securities terminologies are the result of Algorithmic Trading.

Fraud Detection

Frauds have always been a major concern for financial institutions. Moreover, the risk increases with an increase in the number of transactions. Thanks to big data and analytical tools, it is now possible for financial institutions to keep track of frauds. The most common type of fraud a financial institution comes across is, Credit card fraud.

To curb this, the machine learning tools identify unusual financial purchases through the account & prompt the institution to block the account so as to minimize the losses. Not only this, but Data Science also helps in preventing a lot of trading & insurance related frauds through through use of various machine learning.

.png)