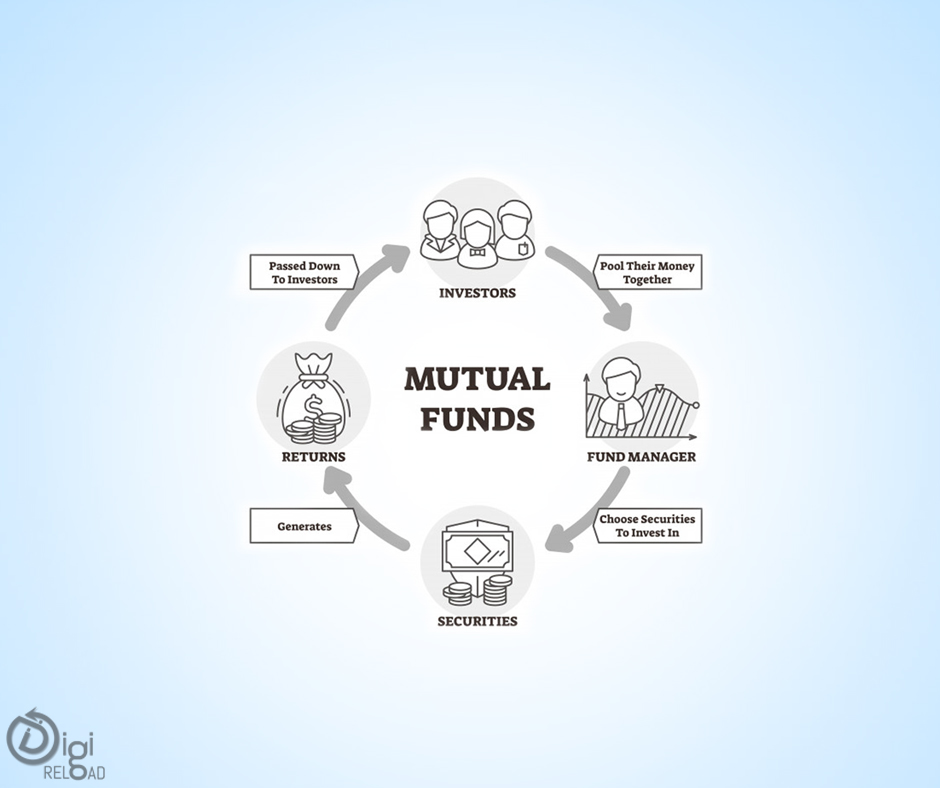

Mutual funds offer perhaps the most thorough, simple, and adaptable approaches to make a broadened financial arrangements for investment. Any mutual fund will either invest in equities, debt, or a combination of both. Mutual funds are:

- Open-ended meaning you can invest or enter and redeem or exit at any point of time, with no fixed maturity period, and

- Close-ended meaning there's a fixed maturity date.

In this blog, we will look at types of mutual funds to know before investing.

Equity

These are quite possibly the most mainstream common asset plans. They permit financial backers to take an interest in securities exchanges. Despite the fact that ordered as high danger, these plans likewise have an exceptional yield potential over the long haul.

They are ideal for financial backers thriving acquiring stage, hoping to assemble a portfolio that gives them better returns over the long haul.

Equity funds are also called as diversified funds as your money is invested in a range of sectors to distribute the risk.

Money market funds

These assets put resources into transient obligation instruments, hoping to give a sensible re-visitation of investors throughout a brief timeframe. These assets are appropriate for investors with calculated risk by investing safely for a short period of time.

In contrast to investing in money market funds, you can also open a savings bank account as it also gives you same percentage of returns but the only difference is it is banking and not investing in stocks.

Fixed income

If you are the kind of investor who does not want to gamble much, you must invest in Fixed Income mutual funds. These kinds of mutual funds offer low returns as the risk involved is also low. The money is invested in instruments such as Government securities, bonds, debentures, etc which yield very low returns.

However, there is credit risk.

Balanced funds

As the name proposes, these are shared asset plots that split their ventures among value and obligation. The allotment may continue to change depending on market conditions. They are more reasonable for financial investors who are taking a gander at a mix of moderate-risk and want to earn a decent amount of returns

Monthly Income Plans

These assets are like balanced assets however the extent of valuable resources is lesser contrasted with balanced assets. Thus, they are likewise called minor value reserves or marginal equity funds. They are particularly appropriate for financial investors who are retired and need a mode of regular income.

Gilt funds

The money is distributed only in government securities in Gilt Funds. This option again is for the investors who don't want to take risks and want a fixed sum of income. Government securities are the best means for investors who want to invest but stay secure. However, Gilt funds are prone to a high rate of interest.

.png)