A basic understanding about getting rich is knowing that wealth is not earned, it is created. In the words of the greatest investor of all times - Mr. Warren Buffet "Do not save what is left after spending, but spend what is left after saving." this has to be an ideal approach for beneficial investment. Lets delve into strategies you need to implement in order to create long term wealth:

Be Patient

There's no other way, believe me. Do a thorough research, talk to your friends, who have a reliable investment acumen, for consultation. Once your research is done, approach to the next step i.e, investing. After you have invested just sit back patiently & believe your decision & stay invested for long. Remember, there is no shortcut to success, similarly any appreciation in assets take time.

So you have to be disciplined when investing into equities or other investment instruments as volatility is a fact.

Take Calculated Risk

To overcome a challenge, taking risk is inevitable. This fact is applicable in investments too but at the same time you are required to take the amount of risk that is bearable & won't shake your financial condition. For this you must be thoroughly aware of your existing financials as well as about your investment plans.

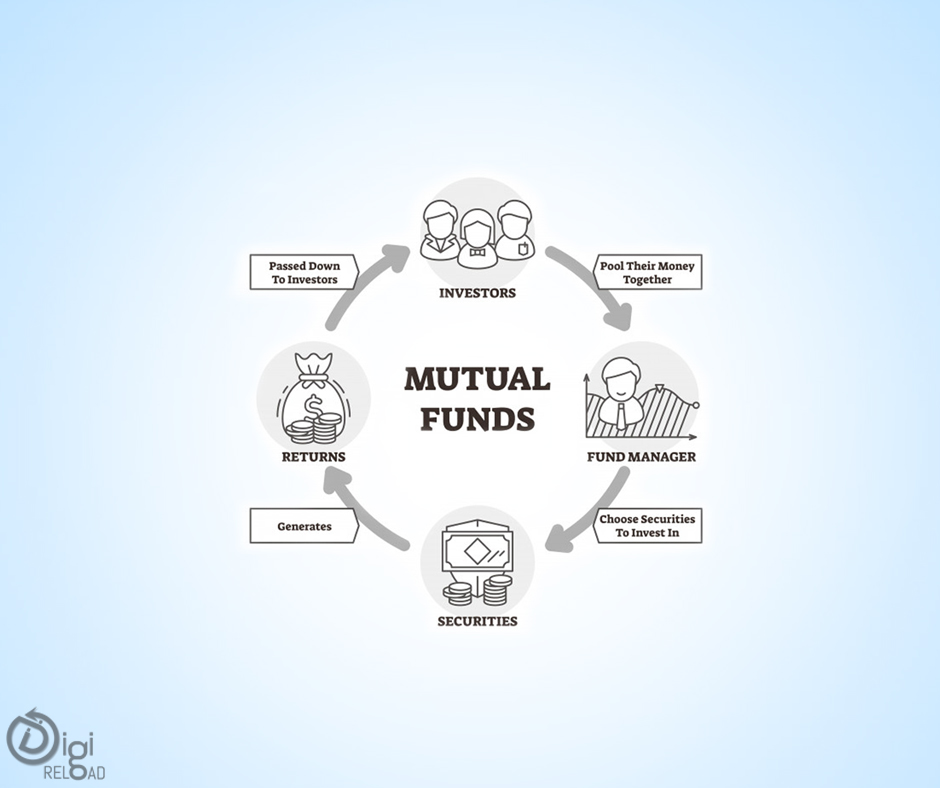

Channelize Your Investment

In simple words, don't invest all your wealth in a single investment scheme or instrument, instead use multiple channels to chunk your wealth & invest proportionately. This strategy helps you to minimize risk & loss while offering you systematic monitoring over your investments.

Through diversification of your investment in different asset classes such as stocks, bonds, real estate and gold, you become immune from the risk of otherwise pooling all your wealth in one place. This helps you to stay invested for a long time & reap benefits

Choose Your Asset

Whether you are a young investor just starting to invest in market, a proficient investor with good market knowledge or a safe investor with the intention of investing to earn with no risk...it is important that you have your asset decided. It is crucial for the investor to invest according to his risk bearing capacity & choose an investment asset that suits his financial capability also at the same time fulfills his investment objective.

Depending upon your investment appetite you can focus on any of the various asset classes such as equities, fixed deposits, government bonds, gold or real estate.

Define & Focus on Financial Goals

It is recommended to invest for a long term but you have the flexibility to choose the period for which you want to stay invested on a particular asset. Define your financial goals & plan out with proper research & consultation.

.png)