The pandemic has caused chaos in the market resulting in large selloffs in the market, which in turnhas resulted in more liquidity, which may intensify redemption pressure. To counter this scenario, RBI has decided conduct auctions of long-term repo operation (LTRO) of up to three-year tenure of appropriate sizes for a total amount up to Rs 1 lakh crore at a floating rate linked to the policy repo rate.

The RBI governor emphasised that the liquidity availed by banks under the scheme has to be deployed in investment-grade corporate bonds, commercial papers and non-convertible debentures, over and above, the outstanding level of those investments in these bonds, as on March 25, 2020.

Related Article

DON’T Copy Competitors

Digireload TeamWriters copy and rewrite content across every industry, from here in the world of digital marketing to motorcycles to finance to real estate....

How To Do Intraday Trading?

Digireload TeamAfter spending some time understanding about Intraday, it is now time to understand how to do Intraday trading? or what are the requirements to sta...

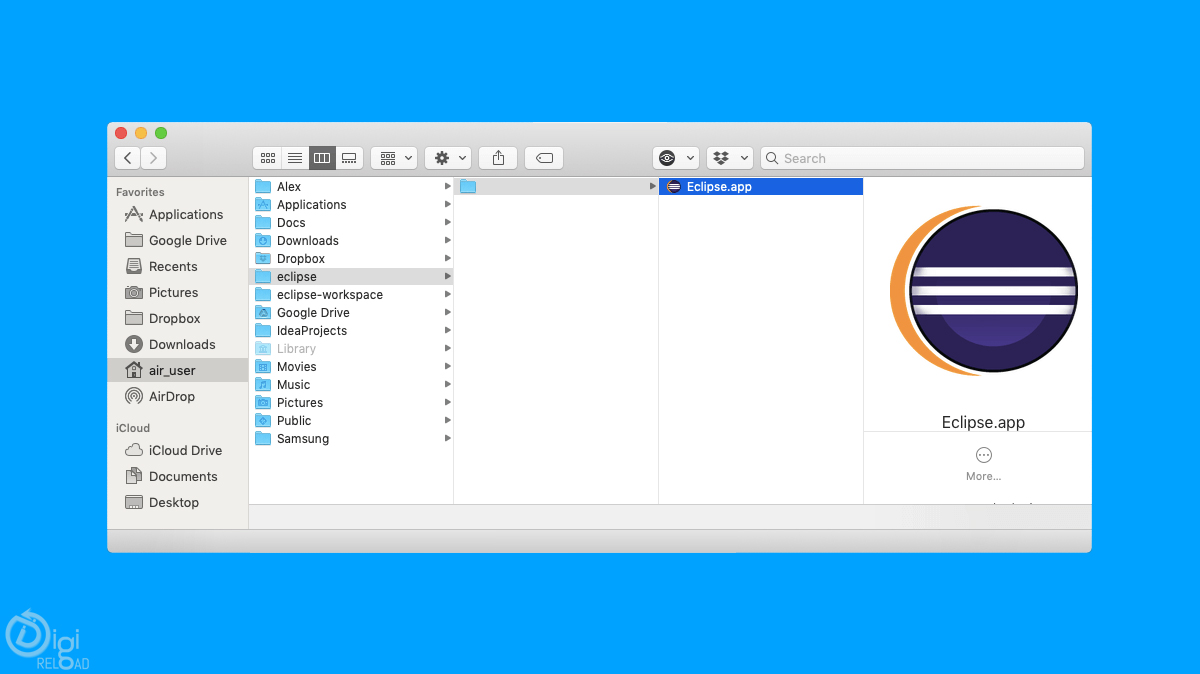

Eclipse

Digireload TeamAnother Java debugging tool to use in 2021 for developers is Eclipse. Eclipse is an open-source IDE with a built-in Java Debugger. Like Rookout, Ec...

.png)