The most important tip to use credit card effectively is to build good CIBIL score. Yes it's true you credit score improves when you clear your dues on time. CIBIL is Credit Information Bureau (India) Limited and is the first credit information company is India. A high CIBIL score means that the person is eligible for a good loan agreement.

RBI requires all banks to check CIBIL scores on all credit cards and credit card applications. You can increase this score by using a credit card. A well-maintained credit card account that pays your credit card on time will help your CIBIL score so you can pay off your loan on time and maintain your existing credit card account.

Related Article

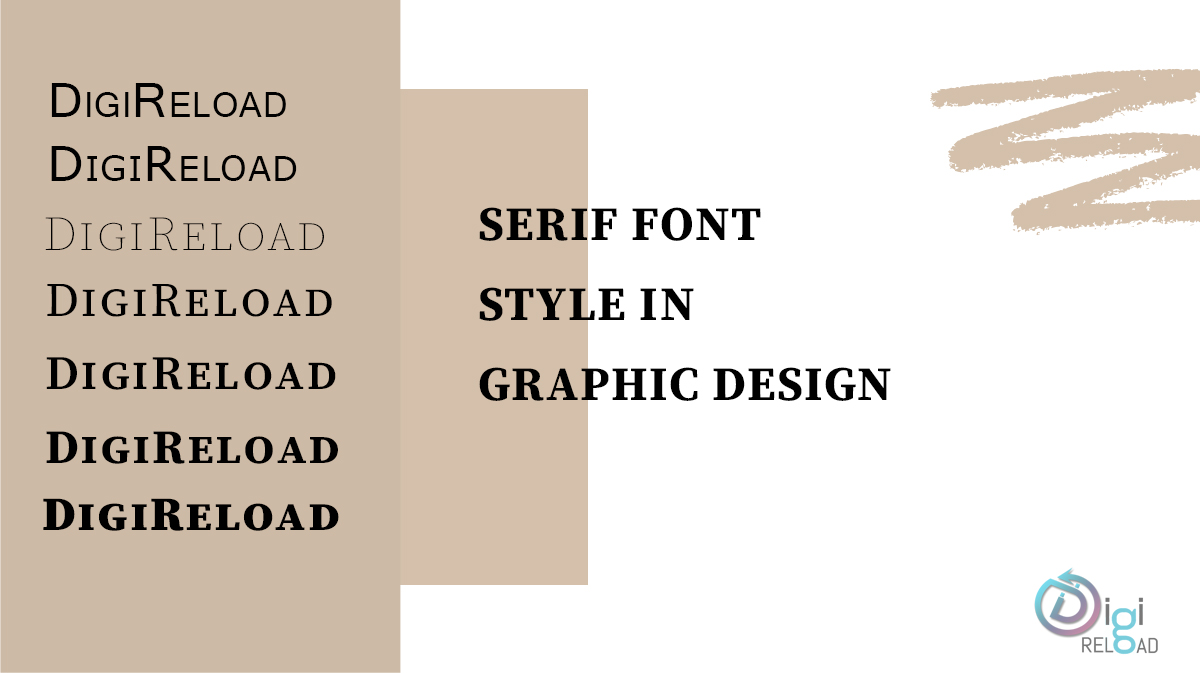

Serif Fonts

Digireload TeamIn recent years, there’s been a move toward sans-serif fonts for a plain look. However, without the serifs and details, a font becomes boring...

KW Finder

Digireload TeamKW Finder helps you get the Keyword that will help you drive highly targeted traffic. Using Questions based Keyword research option you can quickly...

Individual Blog

Digireload TeamHow might it be if you can make a task that won't just assist you with improving your web advancement abilities yet additionally go about as a ...

.png)